Welcome to Piocaro

Piocaro is an innovative investment tool that empowers you to make the right investment choices. Piocaro helps you to discover, compare funds and securities, and create an optimised portfolio that meets your investment goals and risk tolerance.

Here you will learn what you need to get started with Piocaro, and how to sign up for a free account.

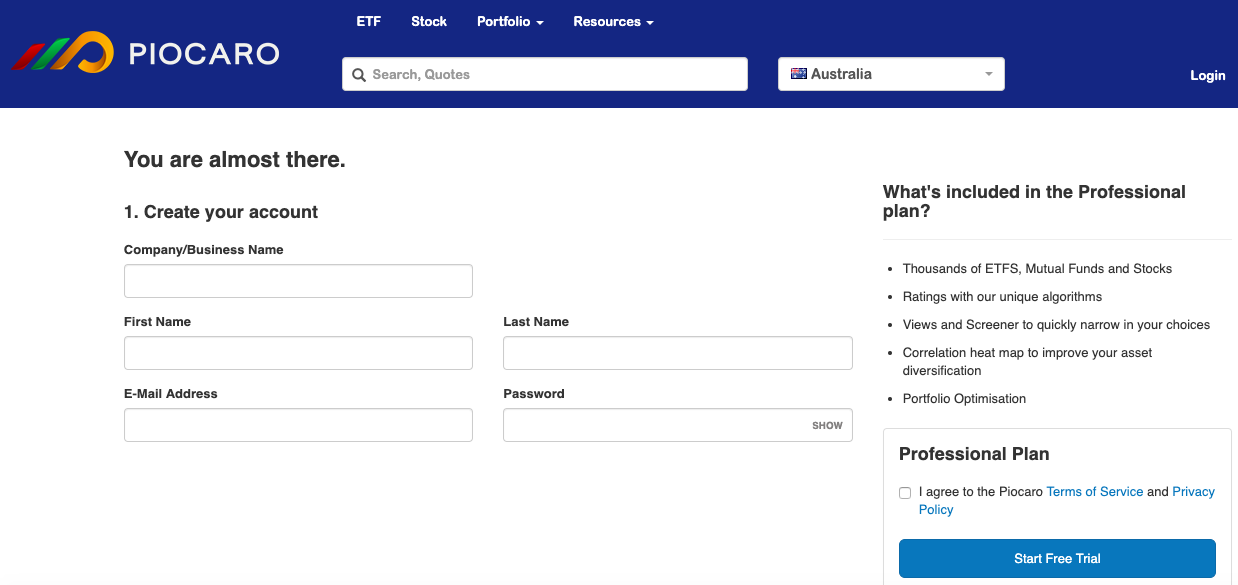

Creating an account

To create your account:

-

Navigate to Piocaro's signup page and click Get Started.

-

Type in your personal details, agree to Piocaro Terms of Service and Privacy Policy and click Start Free Trial.

-

A confirmation message is displayed. Check your inbox for the account activation email to complete your account setup.

The time it takes to receive the activation email can vary. If you haven't received the activation email, check your spam folder.

Discovering your investment options

Piocaro provides comprehensive ratings for over 25 thousand mutual funds, exchange traded funds (ETFs) and individual stocks traded in Australia and the US.

-

A mutual fund is a company that pools money from many investors and invests it in various asset types, including stocks, bonds, commodities and cash. Mutual funds are actively managed, meaning that fund managers make decisions about what securities to buy or sell. Mutual funds typically charge higher fees compared to ETFs because investors have to pay for fund managers` expertise and investment skills.

-

ETFs (Exchange Traded Funds) are a special type of investment funds that typically track a specific market index such as the S&P500 or ASX 200, and can be bought and sold like stocks. Beginning investors or investors with limited capital often choose to invest in either mutual funds or ETFs instead of individual stocks because funds provide far greater diversification than investors could achieve on their own.

-

Stocks allow investors to buy a share in a company. Stocks can be a sound long-term investment, but they are very risky to use in the hope of making a quick return.

Diversification is reducing risk by including a variety of assets into a portfolio. The rationale behind diversification is that a portfolio of different investments will, on average, yield higher returns and pose a lower risk than any individual investment within the portfolio because losses on one asset will be offset against gains on another.

More advanced investors might prefer to use a portion of their capital to buy individual securities and use the rest to buy mutual funds or ETFs that invest in areas about which they are not well informed.

Understanding your investment objectives

Every investment process begins with the assessment of your own investment needs and goals. Here are some investment objectives you can pursue:

| Objective | Description | Investors |

|---|---|---|

| Income | Strategy 1: Achieve maximum safety and stability of investments by focusing on investment options that have low risk (capital preservation) | Investors on fixed income, often retirees, whose primary objective is not to lose any value and gain enough to counter inflation |

| Strategy 2: Provide a predictable income stream from dividends or interest payments | Investors seeking to supplement or replace their current income or meet some short term goal | |

| Growth | Strategy 1: Increase the value of investments over time rather than seeking current income. This is associated with higher degree of risk and longer investment horizon | Long-term investors who are prepared to experience potential short term losses but achieve larger gains in the future |

| Strategy 2: Obtain maximum quick returns by using special investment strategies that involve very high risk (speculation) | Short-term investors who seek extremely high returns | |

| Balanced | Aim for both capital growth and income (dividend) generation | Medium-term investors who are cautious of risk associated with growth options but do not want to sacrifice the potential for returns. |

Piocaro offers a variety of instruments to help you to create a portfolio that matches your investment objectives.

Researching and choosing funds

After you have identified your investment priorities, choose funds and stocks to form your investment portfolio.

-

Choose asset type.

Decide if you want to invest in mutual funds, ETFs, stocks or a combination of several asset types. You choice depends on your investment goals, investment horizon and risk tolerance. In this example, we show you how to research ETFs.

To learn how to analyse mutual funds and stocks, visit Discovering Investment Opportunities and Asset Detailed Analysis pages in the User Guide.

-

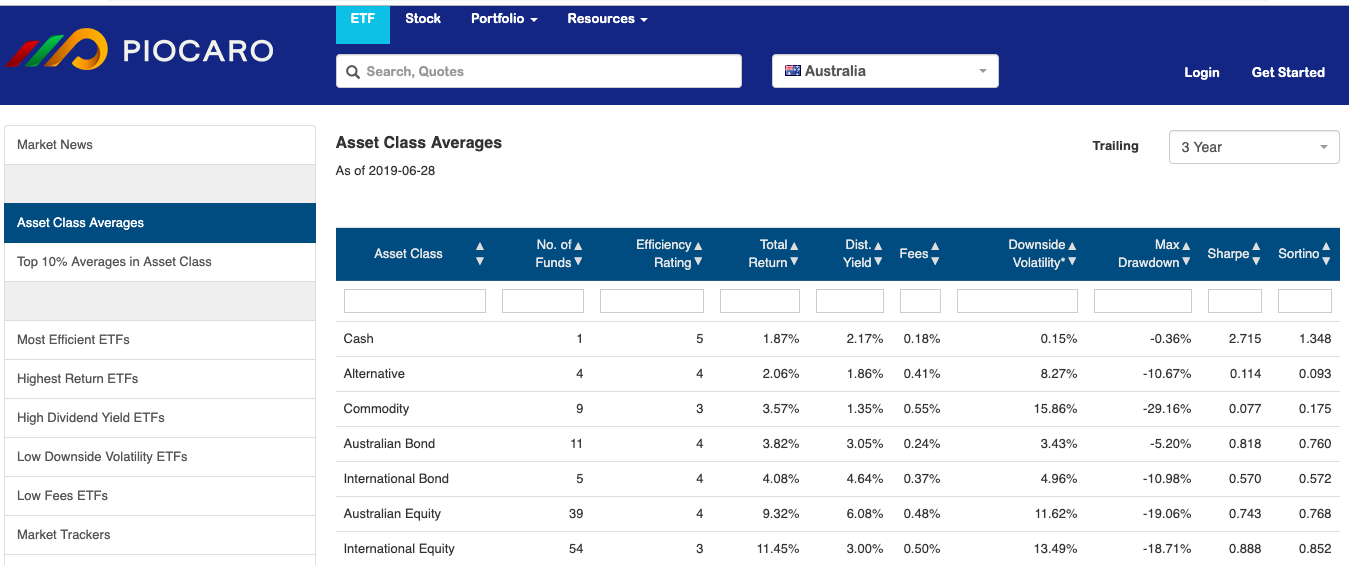

Choose asset class.

With Piocaro you can invest in a variety of asset classes such as bonds, equity, cash or commodities. If you are not sure which asset class to choose, use Asset Class Averages or Top 10% Averages in Asset Class.

-

Asset Class Averages show how each asset class performed within the chosen period.

-

Top 10% Averages in Asset Class show the average within the top performers in each asset class and how those compare with other asset classes.

Investing across a number of asset classes is one of the strategies that helps to diversify a portfolio and reduce its risk. However, different asset classes have different risk-return characteristics. It is important to choose asset classes that are in line with your investment goals and risk tolerance.

To learn more about your investment options, visit Discovering Investment Opportunities page in the User Guide.

-

-

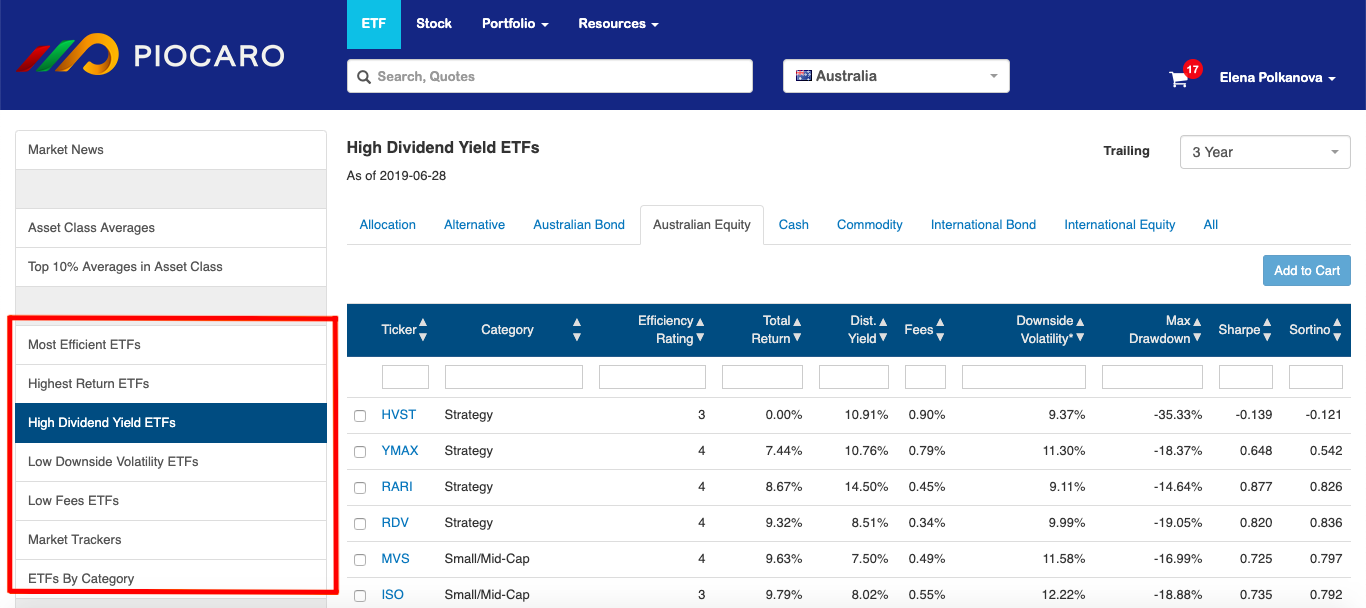

Choose fund.

Piocaro makes it much easier to find a fund that matches you investment objectives. Click an option in the left pane to quickly search for funds in line with your investment criteria.

-

Most Efficient ETFs - The selection of top 10% ETFs in their peer group that have the best tradeoff between return, risk and fees. Suitable for investors who seek balance between these three investment parameters.

-

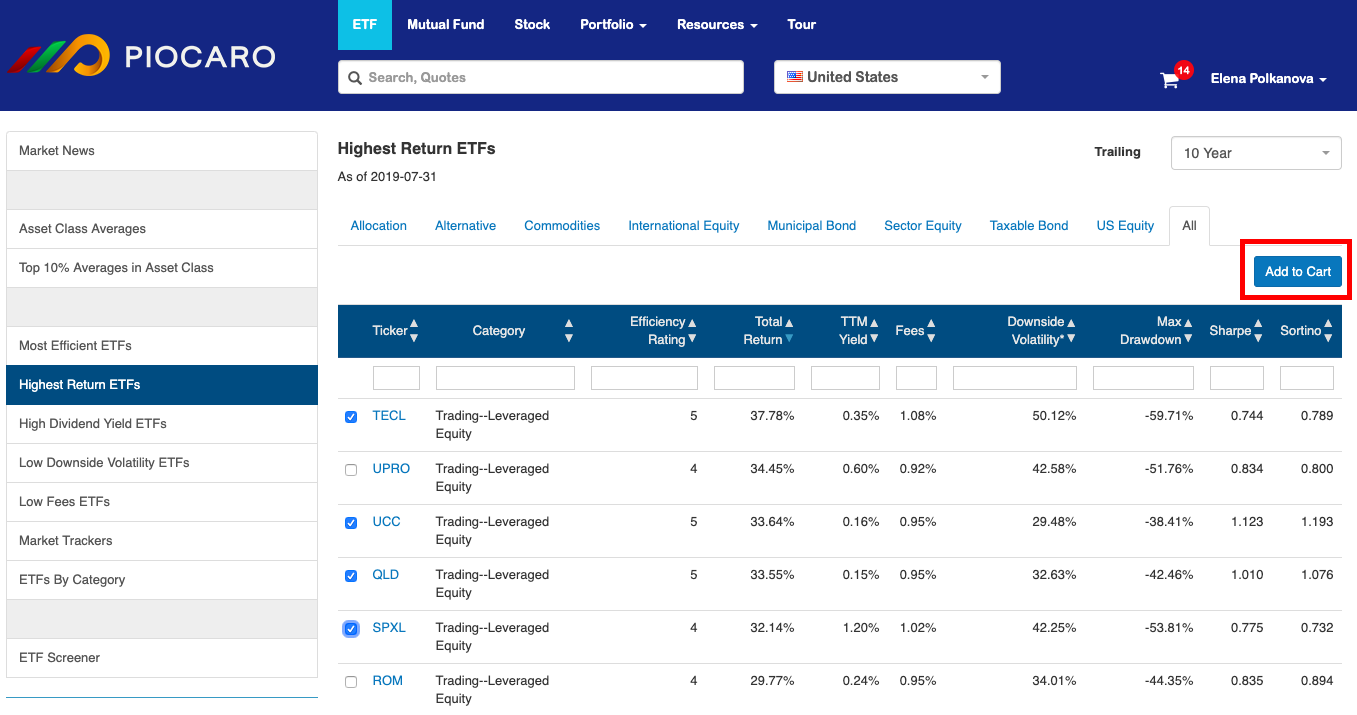

Highest Return ETFs - Funds with a total return in the top 10% of their peer group. This selection is for growth-focused investors whose primary objective is a high return.

-

High Dividend Yield ETFs - The highest dividend paying funds among their peers for income investors who seek regular income streams.

-

Low Downside Volatility ETFs - The selection of funds with the lowest downside volatility (risk) in their peer group for risk-averse investors.

-

Low Fees ETFs - Funds with fees in the lowest 20% of their peer group for those investors for whom low fees are the primary concern.

-

Market Trackers - This function can be used to search for funds that performed most closely to their category benchmark index.

-

ETFs by Category - This function enables you to look for funds in a specific category such as Emerging Markets Bonds or Consumer Defensives.

If your investment priority is Growth, you might start by looking at Most Efficient ETFs or Highest Return ETFs. If you are an Income investor, you might be interested in High Dividend Yield ETFs.

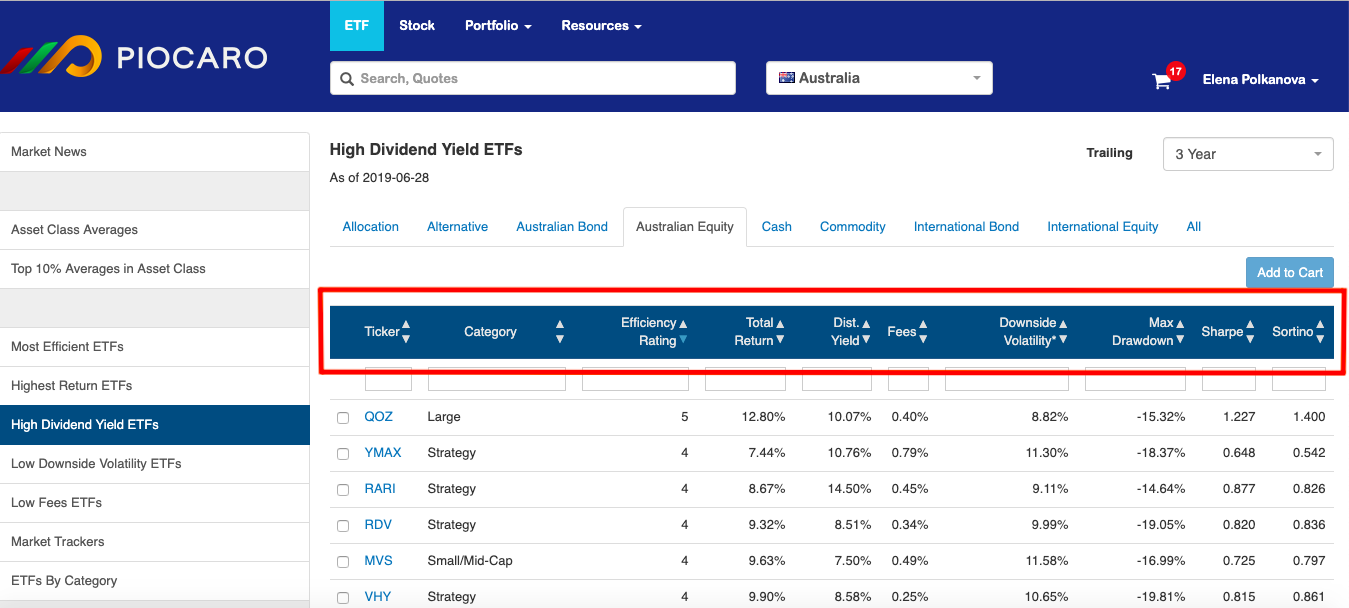

Use the bar in the middle of the page to quickly identify top performing funds in each category.

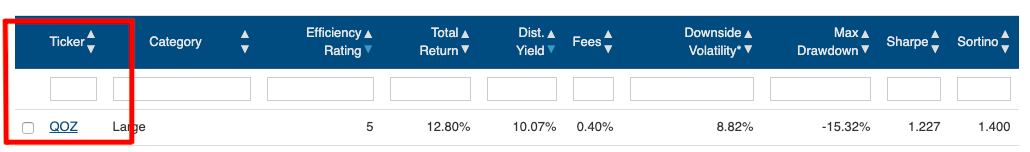

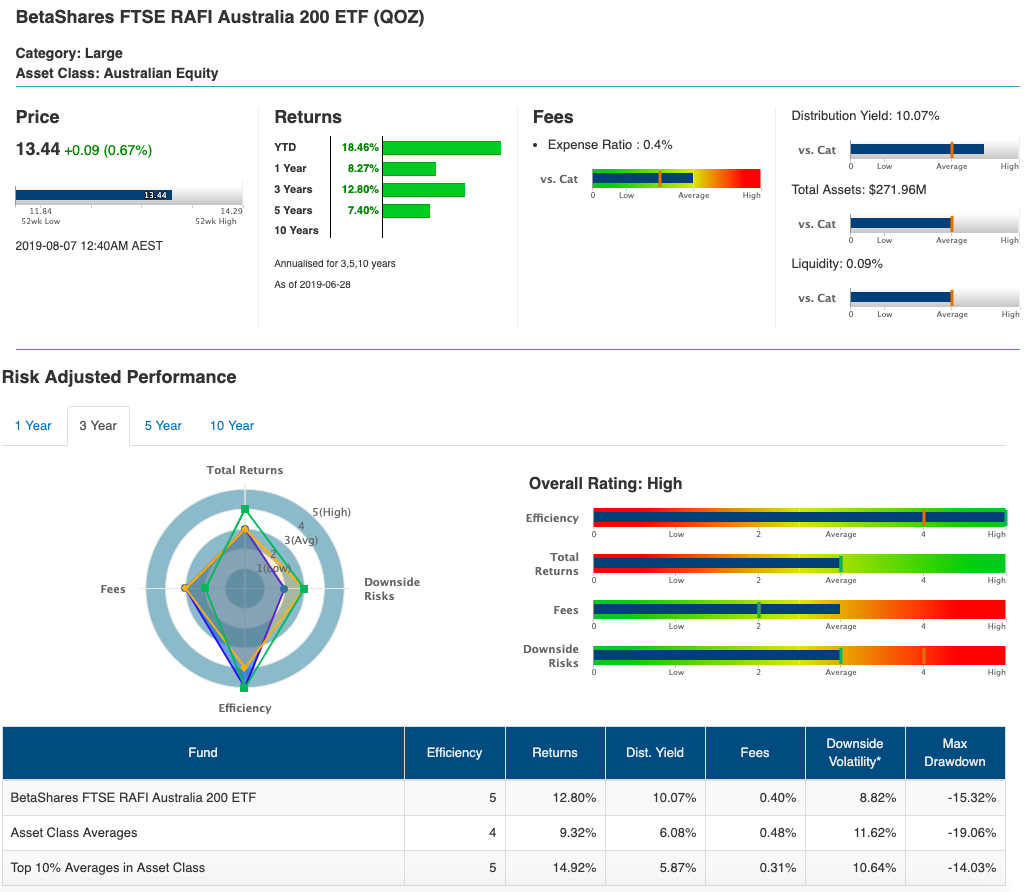

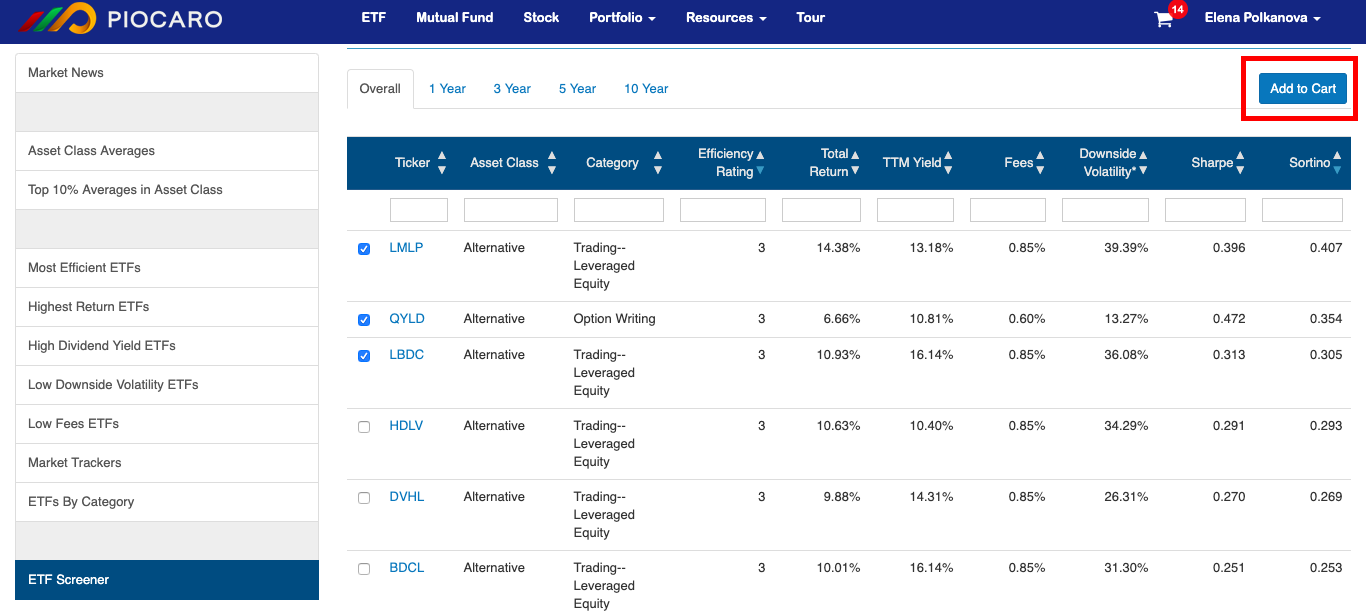

You can sort the list by Category, Efficiency Rating, Total Return, Distribution Yield, Fees, Downside Volatility, Maximum Drawdown, Sharp and Sortino Ratios, depending on your investment goals. If you want to know more about any these parameters, use the Glossary or hover your cursor over the parameter in which you are interested to see the definition.

Piocaro uses a unique approach to ranking funds. We calculate a fund's Efficiency Rating based on three criteria - return, risk and fees. This enables us to answer the important investing question: "How efficient is any particular fund at producing its total return for the level of risk taken (downside volatility) and fees charged compared to other funds in the same peer group?" The most effective funds have a rating of 5 and the least effective a rating of 1. If you are looking for a fund that has a good balance between return, risk and fees, focus on funds with a high Efficiency Rating.

You can find more information about each fund's performance by clicking a fund`s Ticker.

To learn more about how to analyse this information, visit the Asset Detailed Analysis page in the User Guide.

-

-

Add a fund to your portfolio.

Piocaro uses an Asset Cart to temporarily hold the pre-selected funds that you use to build and optimise a portfolio. The Asset Cart icon looks like a shopping cart but the Asset Cart does not allow the buying and selling of securities - it is just a repository.

There are three different ways to add an asset to your Asset Cart:

-

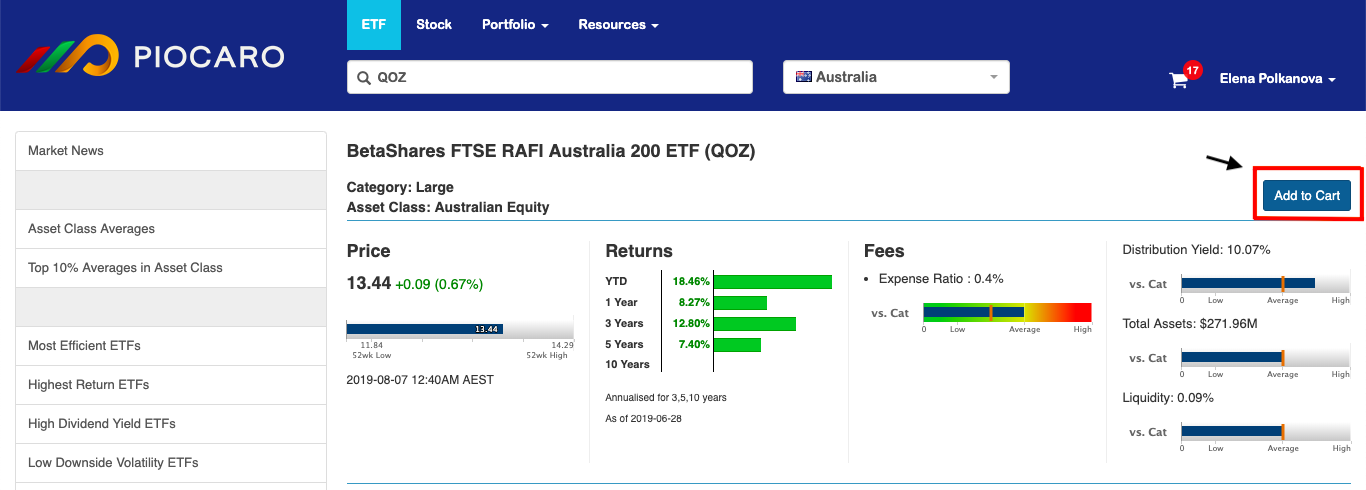

Access a fund's page by clicking its Ticker and click Add to Cart.

-

Select several funds from a category that meets your investment objectives and click Add to Cart.

-

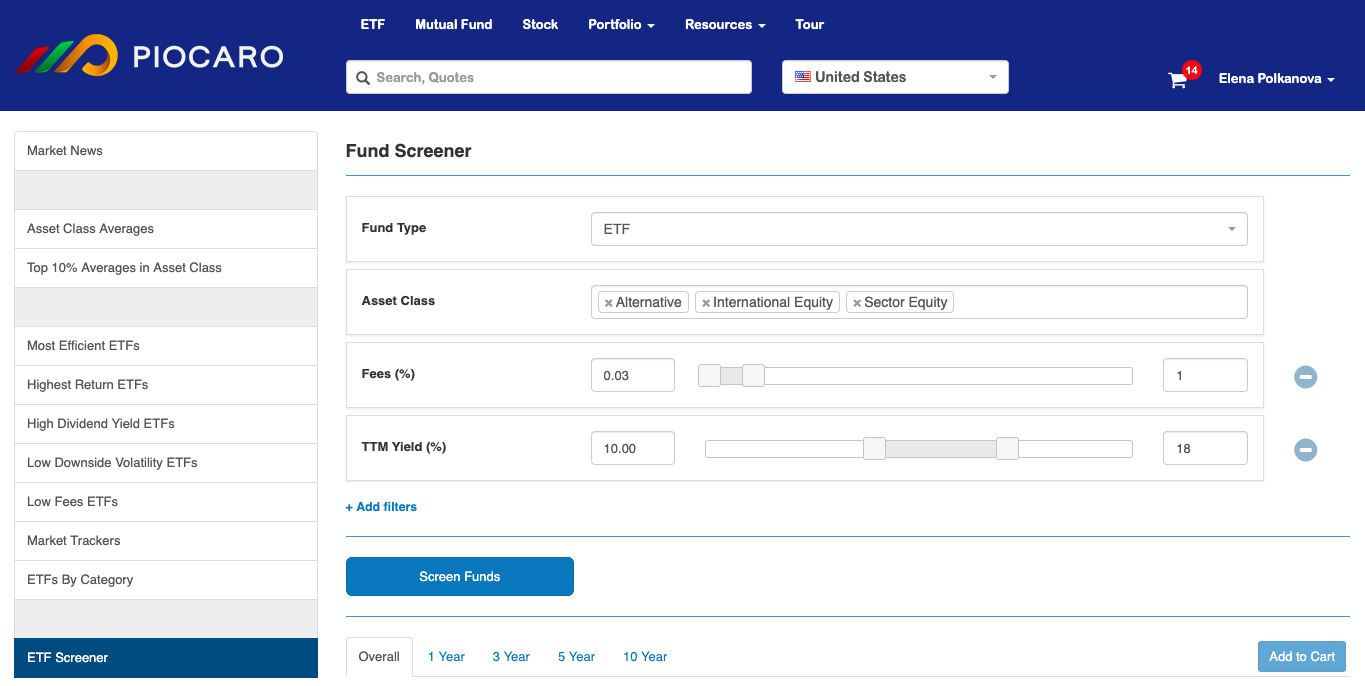

Use the ETF Screener. The ETF Screener enables you to filter all funds in the Piocaro database according to various screening criteria such as asset class, fund family, size (total asset/fund under management), distribution/TTM yield and number of years of operation.

Sort the results as desired, select funds that you want to add to your portfolio, and click Add to Cart.

Sort the results as desired, select funds that you want to add to your portfolio, and click Add to Cart.

To learn more about how to use the ETF Screener, visit Discovering Investment Opportunities page in the User Guide.

To learn more about how to use the ETF Screener, visit Discovering Investment Opportunities page in the User Guide.

-

Creating and optimising your portfolio

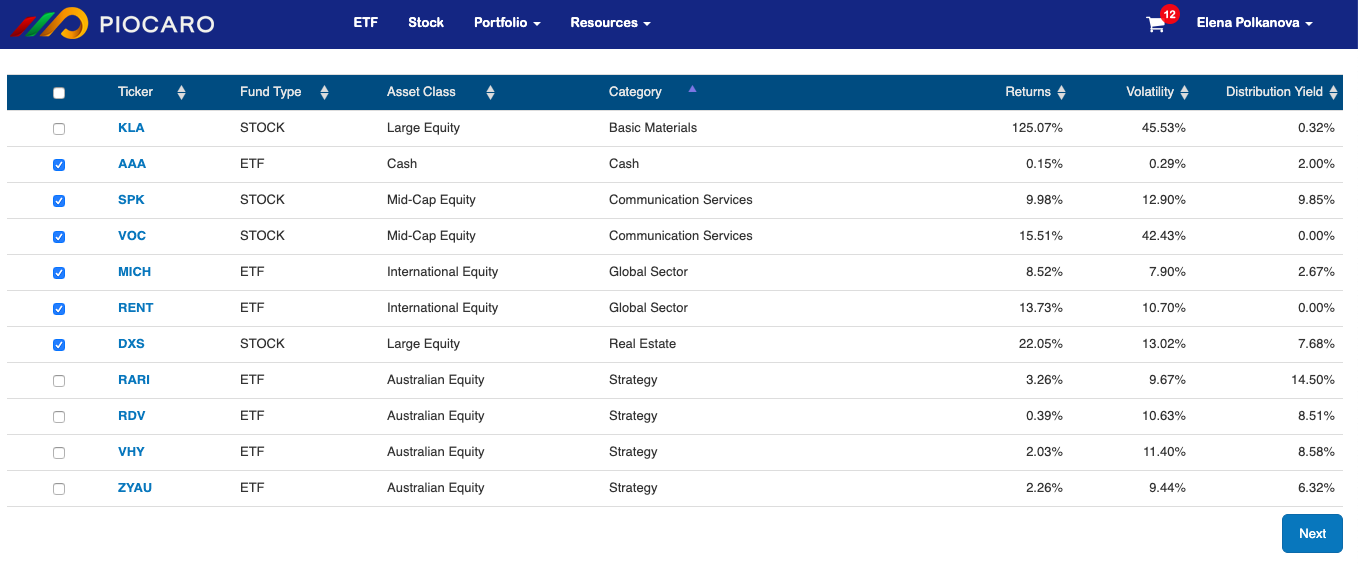

The Asset Cart is a repository from which you make your final choices. Edit, add and select assets in your Asset Cart to create your portfolio.

Before you combine all of your securities into a portfolio, view the correlation matrix of the assets that you have selected.

The correlation matrix gives you an idea of how well your portfolio is diversified. To create a well diversified portfolio focus on securities that have negative, zero or low correlation (green and yellow areas of the matrix). Assets that are highly correlated (red areas) will move in the same direction and the portfolio will be more volatile and risky.

To combine your selected assets into one portfolio, select assets that you want to include and click Next to create the optimised portfolio.

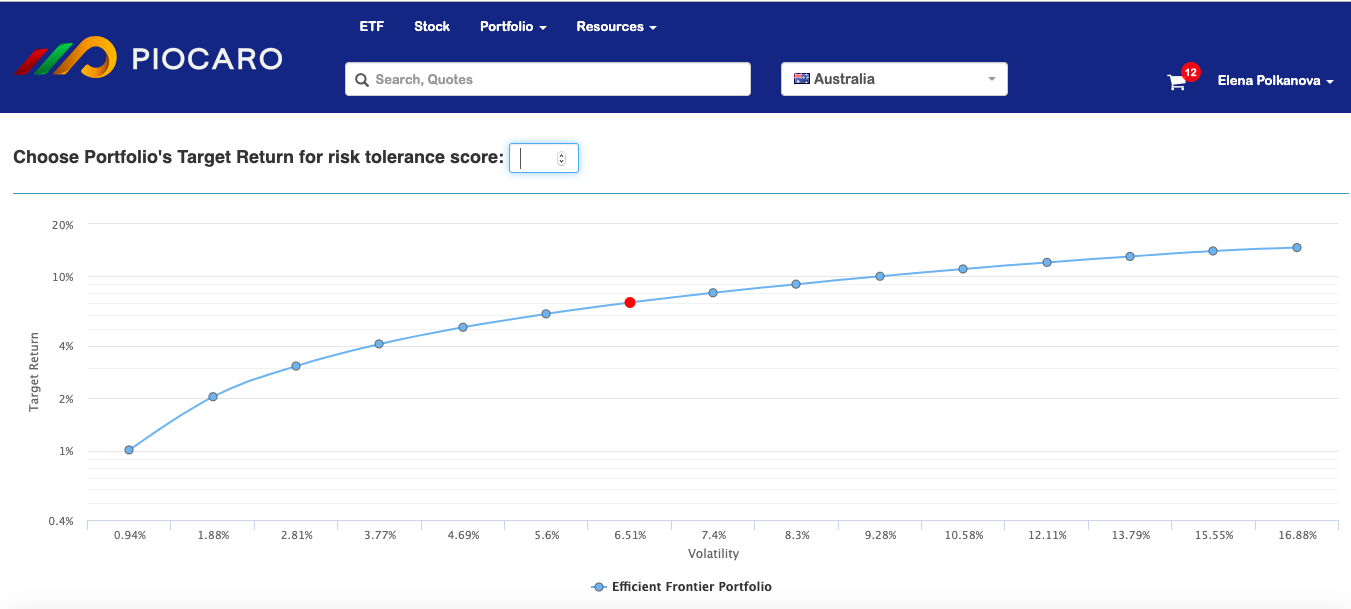

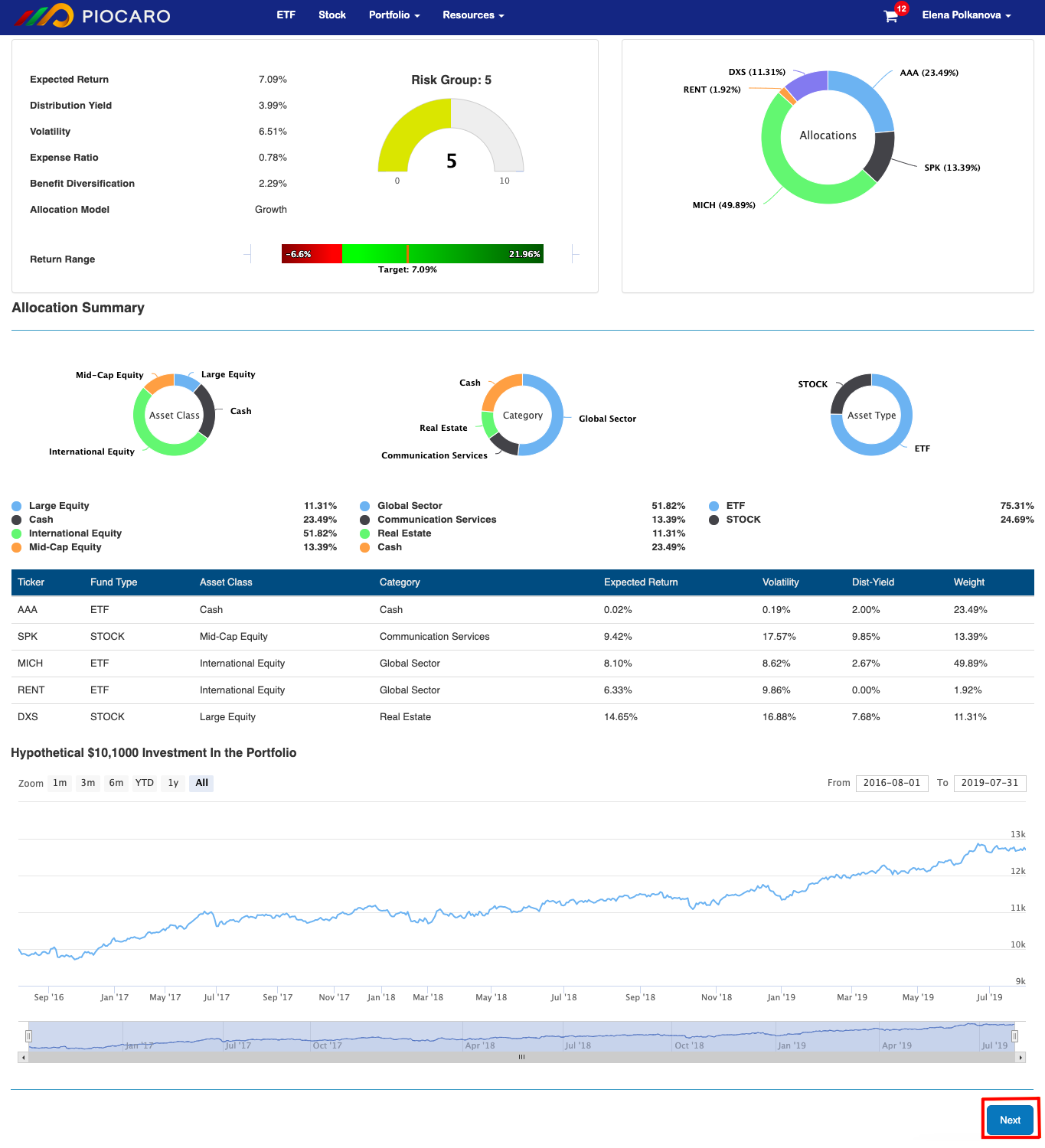

Based on your selection, Piocaro offers you a set of optimal portfolios that are located on the efficient frontier.

Efficient frontier is a combination of portfolios that provide the highest possible return for a given level of risk. All portfolios below the efficient frontier are called suboptimal because they do not generate enough return to compensate for risk. Choose a portfolio that lies on the efficient frontier to get the best risk-return tradeoff.

If you know your risk tolerance score, enter it in the relevant field above the Efficient Frontiers chart and get the portfolio that matches your risk tolerance. If you do not know your risk tolerence score, view information about portfolios on the efficient frontier and choose the one that best meets your investment objectives.

Navigate through the efficient frontier to get a brief idea of each portfolio's main characteristics, such as its projected return range, target return, distribution yield and risk group (the lower the risk group, the lower the portfolio overall risk).

.gif)

For each portfolio that you select Piocaro provides easy to understand infographics that highlight the key features of the portfolio, including its risk and total return, allocation summary, asset weights and the portfolio's hypothetical performance.

To learn more about choosing your optimal portfolio, visit Choosing Among the Optimised Allocation page in the User Guide.

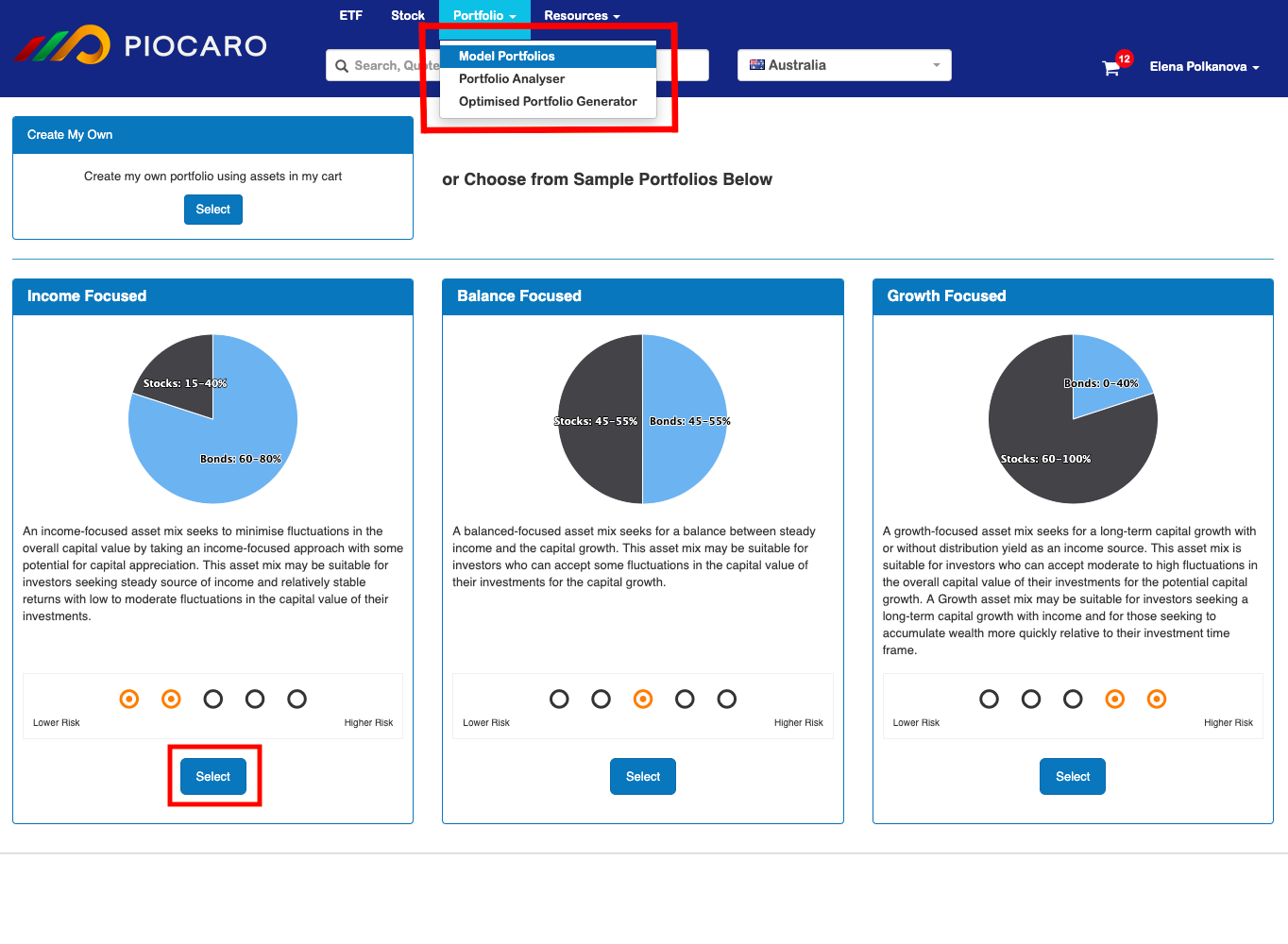

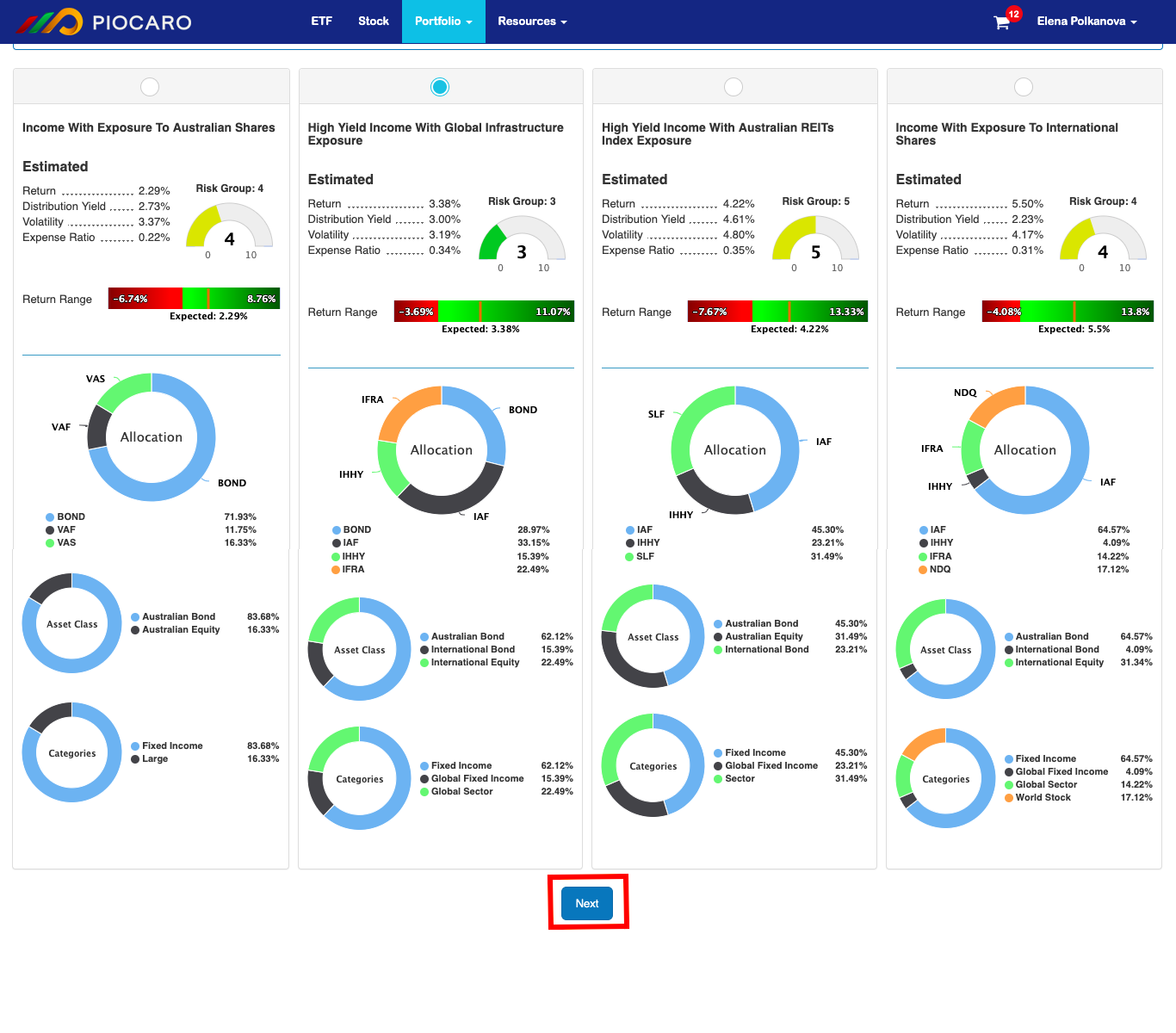

For investors who want more guidance in choosing their investment, Piocaro offers Sample Portfolios that meet various investment objectives.

For each allocation mode, Income, Balance and Growth, Piocaro has designed several portfolios with different characteristics.

Click Next to enter the amount you want to invest and save you portfolio.

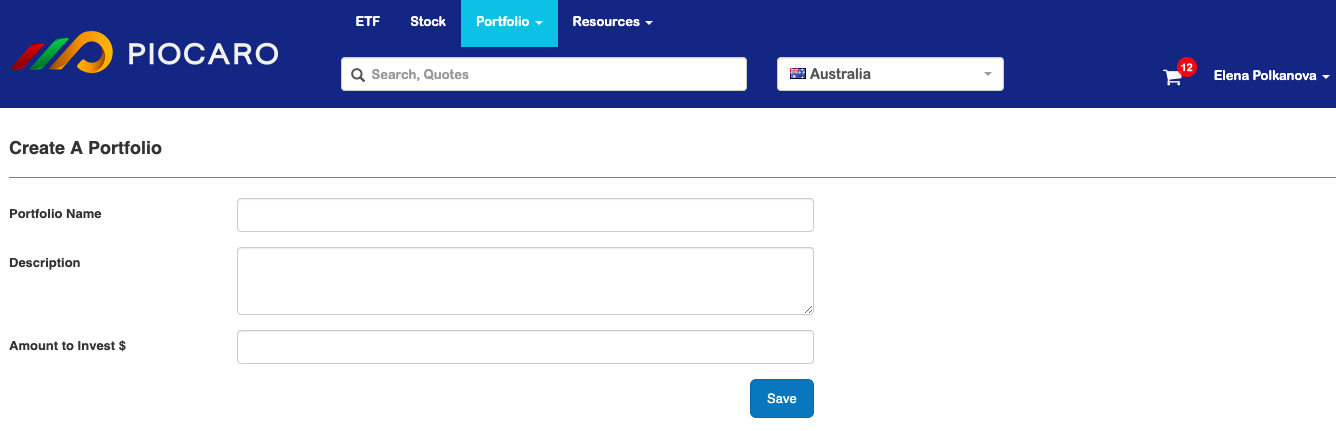

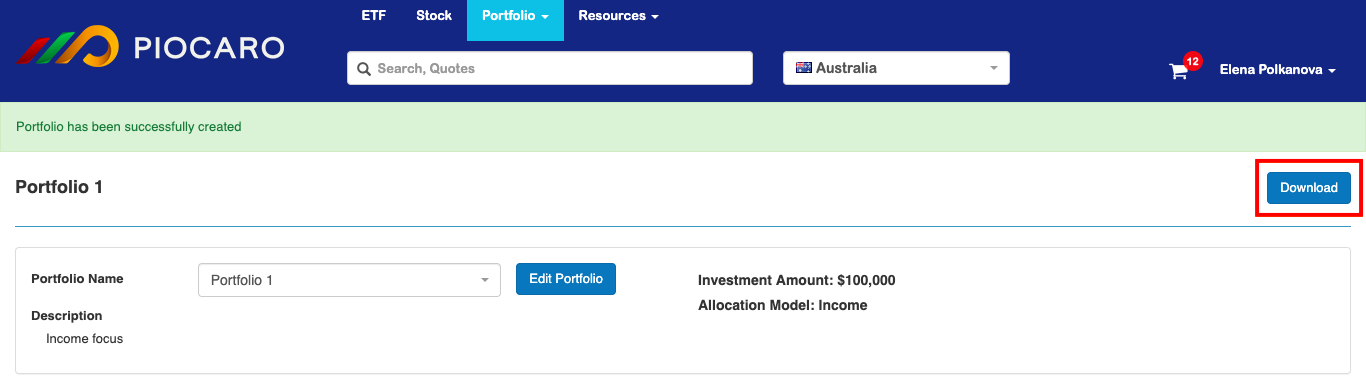

Saving your portfolio

To save your portfolio, simply type in your Portfolio Name, Description and the Amount to Invest.

After you click Save, a summary of your investment is displayed with return targets, the risk levels, and asset allocations that you intend to invest.

Click Download to obtain a summary of your investment portfolio that you can send to your broker.

You will obtain a PDF document which highlights the key features of your portfolio for your record and an Excel document with asset allocations to send to your broker.

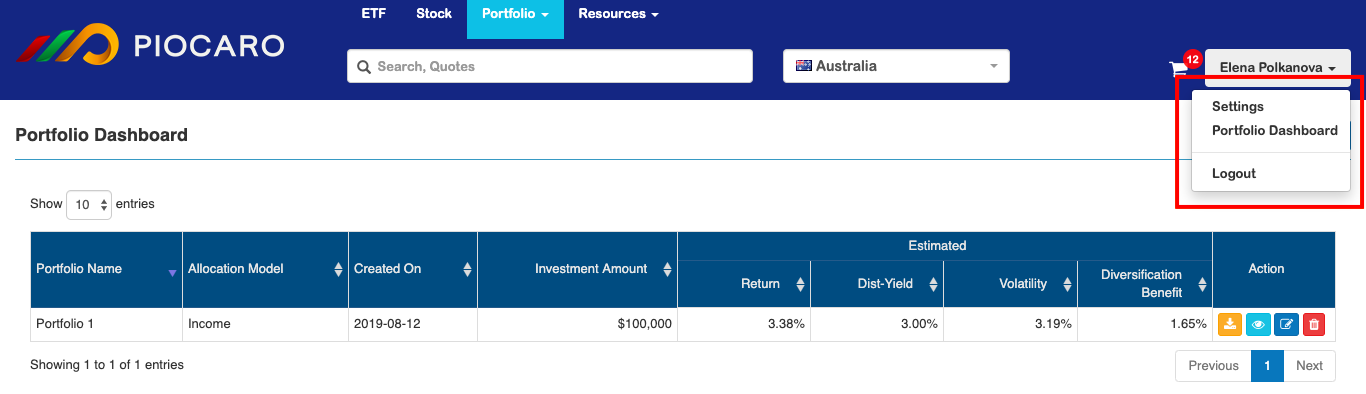

Use the Portfolio Dashboard to view, download, edit or delete any of your portfolios.

Please refer to User Guide menu and FAQs to find more detailed information about investing with Piocaro.