Discovering Investment Opportunities

The following two real-life scenarios demonstrate how Piocaro can help you to find investments that match your investment objectives.

Scenario 1 - Growth

Veronica is a young professional who wants to invest money to save for a house. She has calculated that she needs to obtain returns of at least $10.000 a year to meet her investment target in 10 years. Veronica is willing to accept a reasonable level of risk to gain higher returns on her capital in the long term.

Veronica is not a very sophisticated investor, so she has decided to allocate most of her capital to funds because she does not think she can diversify her portfolio well enough if she picks individual stocks by herself. Veronica has decided to focus on ETFs because they offer lower fees.

Because Veronica is a growth investor with a long investment horizon, she also wants to allocate a small portion of her money into stocks because of the potential for higher returns.

Discovering ETFs

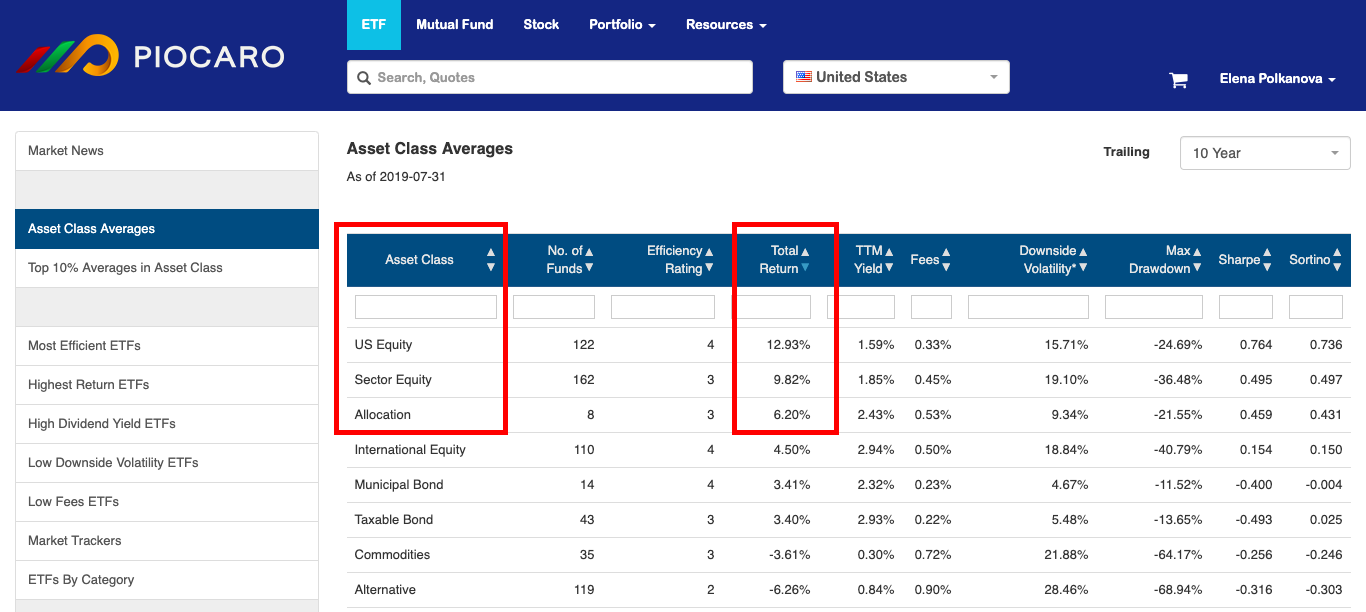

Veronica starts by deciding which asset classes she wants to invest in. She views Asset Class Averages to see how various asset classes performed over 1, 3, 5 or 10 years to identify the best performing asset classes that meet her objective.

It is a good strategy to invest across different asset classes to obtain the benefits of greater diversification.

As Veronica is a long term investor, it is reasonable for her to focus on funds' performance over longer trailing periods. She might choose to sort asset classes by Efficiency Rating or, alternatively, as a Growth investor, she might decide to focus on asset classes that earn higher returns.

After Veronica has considered various asset classes, she might think about diversifying further by choosing different sectors, or categories, within each asset class.

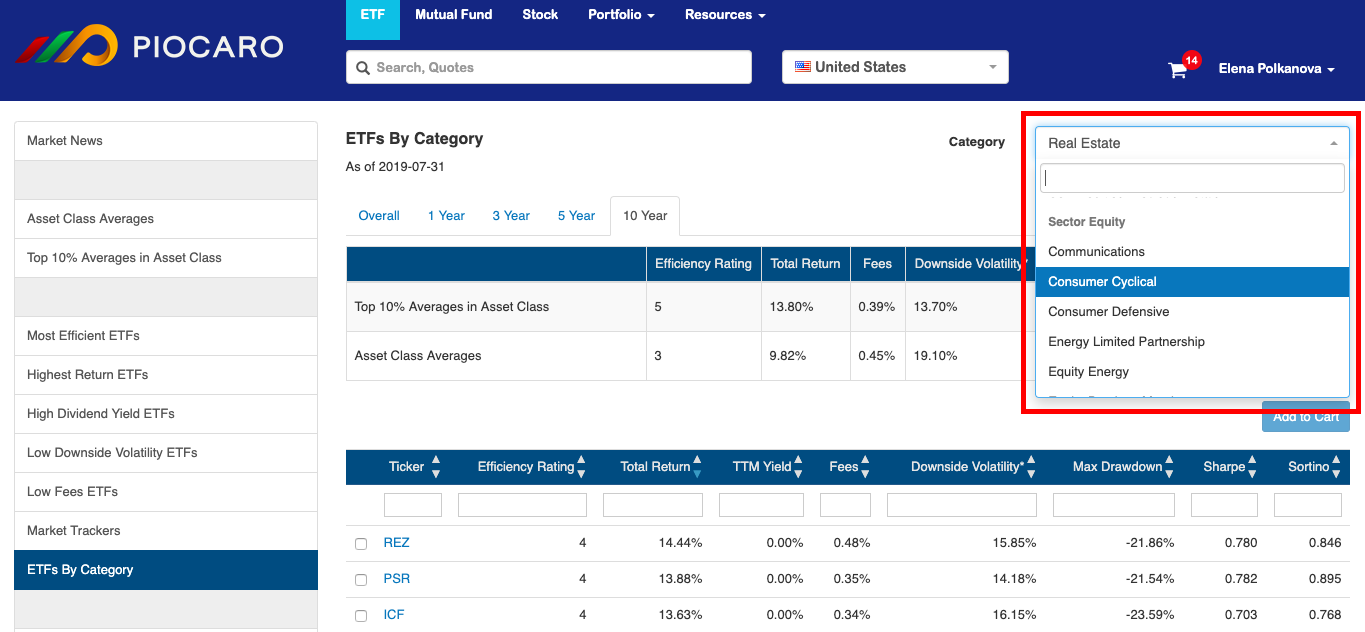

Veronica views ETFs by Category to compare funds that invest in a particular sector or industry; for example, Real Estate or Technology.

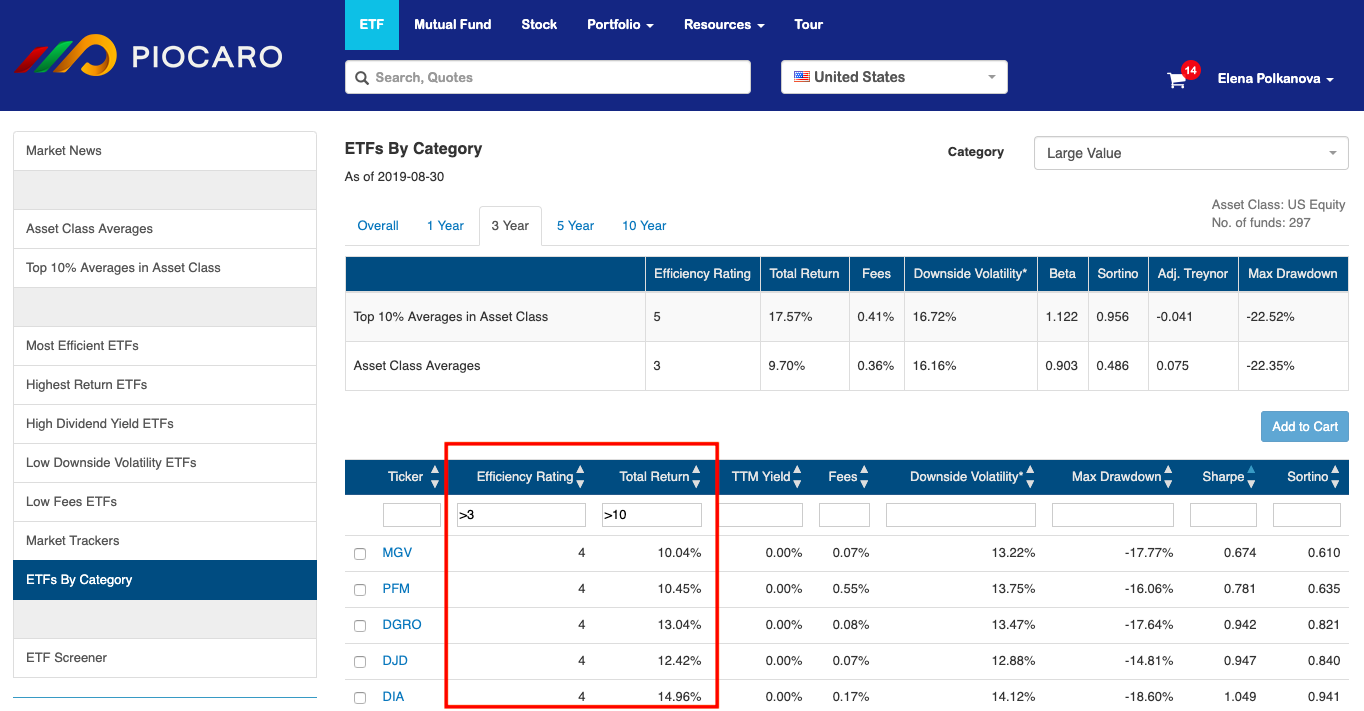

By sorting and filtering the funds, Veronica discovers the top performers in each category that meet her return targets and risk tolerance. For example, Veronica might want to filter the funds in the category she has selected to show only those ETFs that deliver higher than 10% return and have an efficiency rating of more than 3.

There are a number of other ways how Veronica can discover funds that invest in asset classes and sectors she has selected.

-

Investors who seek capital growth, like Veronica, might want to choose funds from Most Efficient ETFs or Highest Return ETFs. Piocaro enables comparison of funds across different parameters, including Efficiency Rating, Total Return, TTM Yield, Fees, Downside Volatility, Max Drawdown, Sharp and Sortino Ratios. None of these parameters should be viewed in isolation - consider them in combination. Veronica can further analyse these parameters to identify the funds that best meet her objectives.

-

Veronica can choose to view Most Efficient ETFs to find suitable investment options. If low fees are important to her, she can sort the funds by the fees they charge. She might also want to look at Downside Volatility and Max Drawdown to identify the potential level of losses she can tolerate if the asset does not perform well. Two other important parameters to examine are Sharp and Sortino ratios as they demonstrate how well an investor is rewarded for risk. Higher ratios are desirable as they indicate that less risk is involved in producing returns.

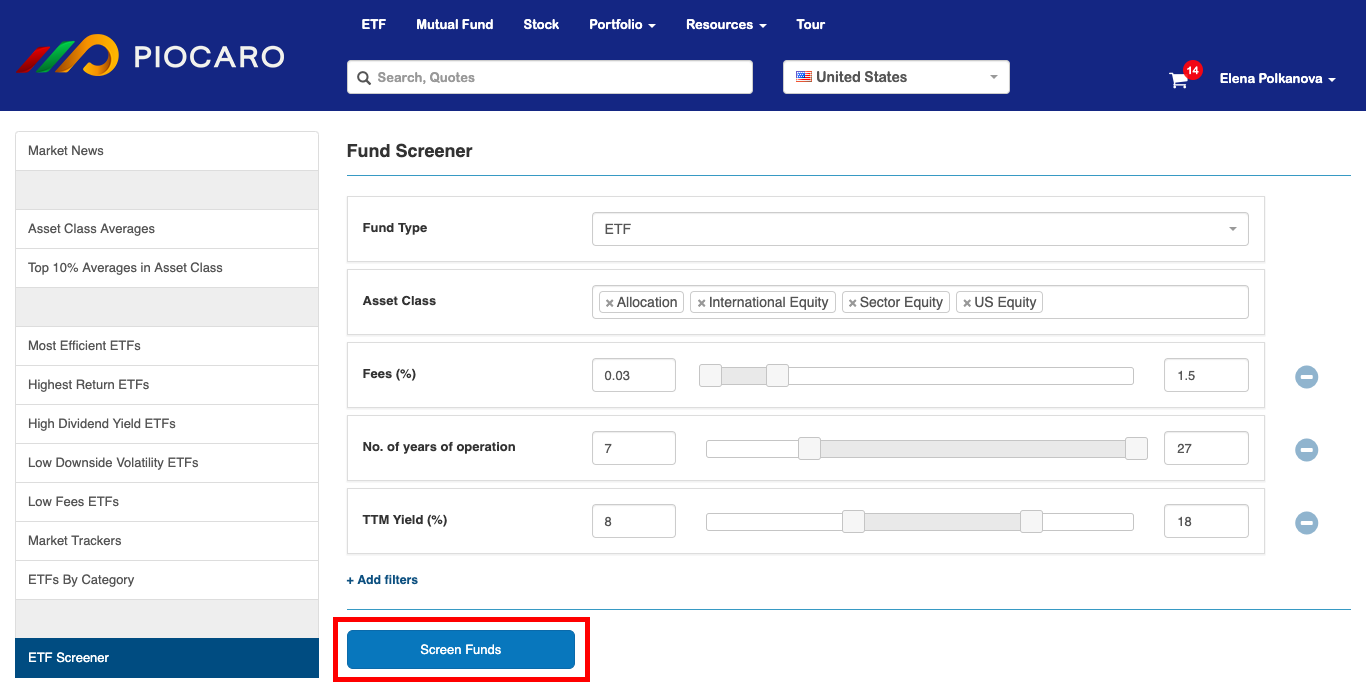

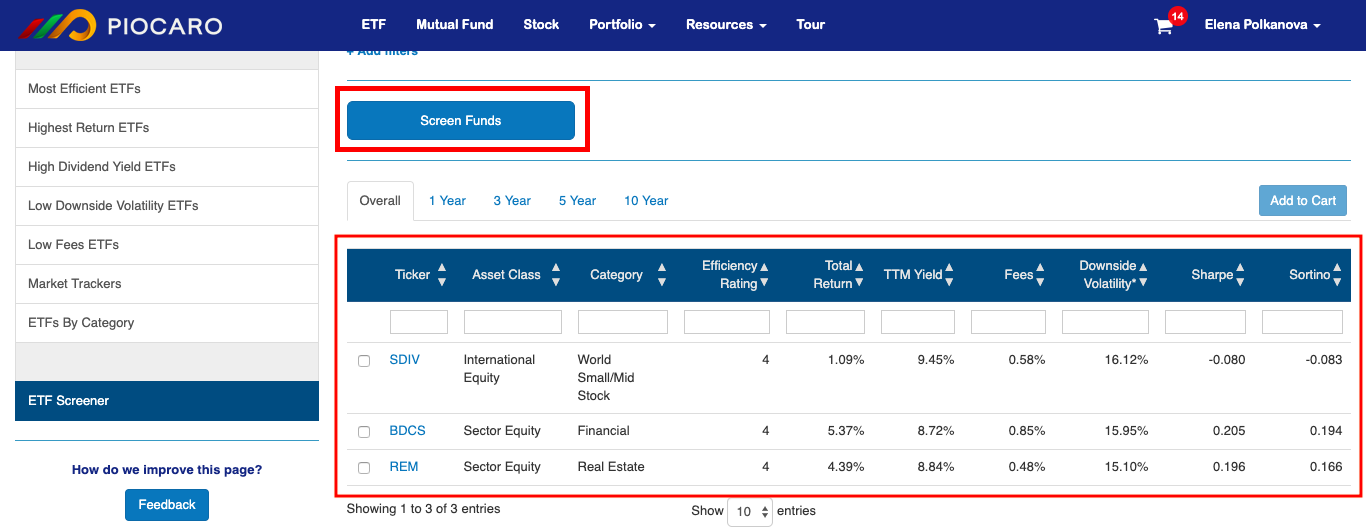

Another way to select funds for Veronica is to use the ETF Screener. This option is particularly useful if there are a number of parameters that are important for an investor.

The fund screener enalbes you to filter all funds in Piocaro database according to various screening criteria. These include: asset class, category, fund family, size (total asset/fund under management), distribution/TTM yield, number of years of operation and so on.

Veronica can apply different filters to identify only those ETFs that meet her criteria. She can choose a Fund Type (either ETFs or Mutual Funds) and select multiple Asset Classes in the dropdown menu. She does not want to pay high fees so she sets the Fees range to be between 0.03% and 1.5%. Veronica wants to invest only in those funds that have been in Operation for more than 7 years and sets her target TTM Yield to be between 8% and 18%. This is how these Screener filters will look for Veronica.

By clicking Screen Funds she gets only those funds that meet the parameters she set.

Discovering Stocks

Although Veronica's primary investment assets are ETFs, she also wants to include some good performing stocks to her portfolio to increase its total return.

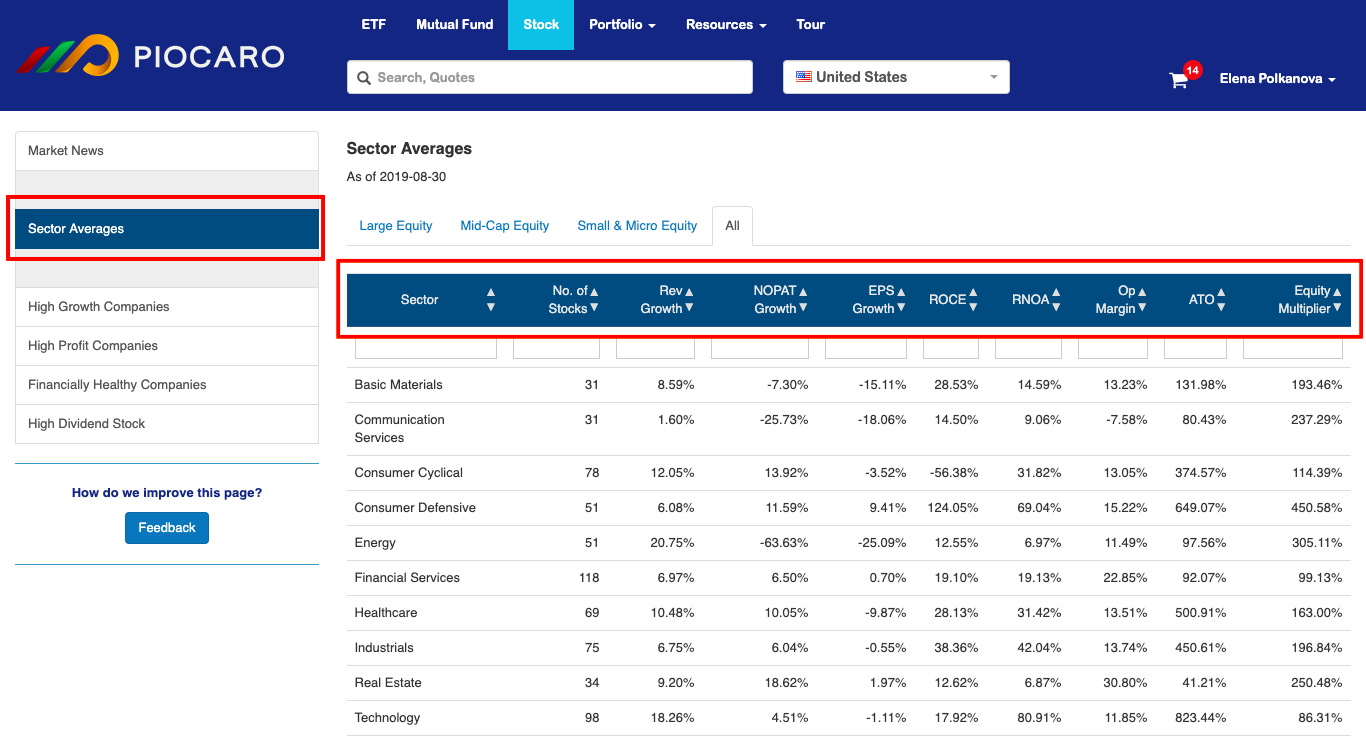

Sector Averages gives Veronica an understanding of how different economic sectors (Utilities, Financial Services, Technologies, etc.) performed for each equity class (Large Equity, Mid-Cap Equity and Small & Micro Equity). As with ETFs analysis, she can sort and filter the results by various financial parameters (Revenue, NOPAT, EPS growth, ROCE, RNOA, etc.) to identify the best performing sectors.

Different economic sectors perform better at different times. Investors who want to diversify their portfolios and make overall returns less volatile spread their funds across a number of different sectors.

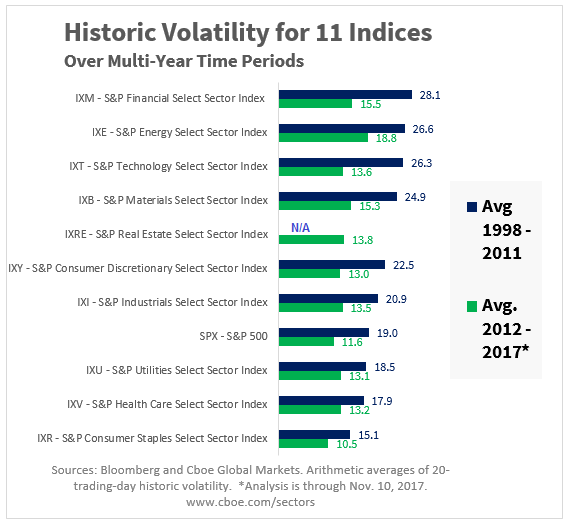

It is important to note that economic sectors also have different risk characteristics.

These characteristics need to be taken into account when making an investment decision. For example, as Veronica does not want to take too much risk, she is likely to invest in lower-risk sectors such as Consumer Staples, Healthcare and Utilities and avoid high risk sectors such as Energy or Financials.

The risk of different equity classes - Large, Mid-Cap and Small & Micro - also varies.

Small and Micro cap companies tend to be riskier than Large cap companies. They typically have better growth potential and returns but they do not have the resources of large companies, making them more vulnerable to negative market events.

Thus, investors like Veronica who want to avoid excessive risk exposure might choose to invest mostly in Large and Mid-Cap equity.

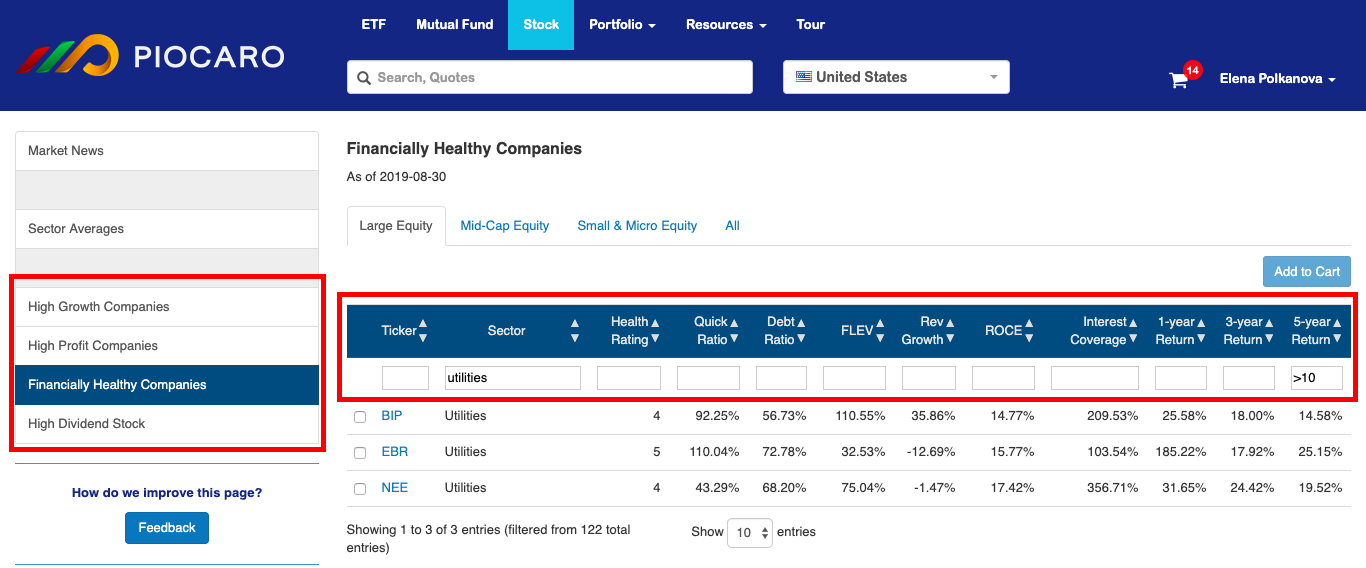

Similar to ETFs, Piocaro has selections of stocks for different investment goals. These include High Growth Companies, High Profit Companies, Financially Healthy Companies and High Dividend Stock.

-

High Growth Companies - Companies that demonstrate the highest growth rates compared to their peers for investors who seek high capital appreciation.

-

High Profit Companies - Companies with high profitability for investors who focus on high performing companies.

-

Financially Healthy Companies - Companies that have a stable financial position, profitability and liquidity. Suitable for income and risk averse investors.

-

High Dividend Stock - High dividend yield companies for investors who seek consistent income streams.

Veronica might want to focus on High Profit and Financially Healthy Companies as she is looking for high performance moderate risk stocks.

She can also sort and filter stocks in these categories to identify those that meet her objectives.

Scenario 2 - Income

David has recently retired. He has some savings and he wants to invest to receive supplementary income in addition to his pension. David is cautious about risk because he needs a stable and reliable income stream. He wants to obtain an income-focused portfolio that has a small exposure to growth assets to achieve overall portfolio growth.

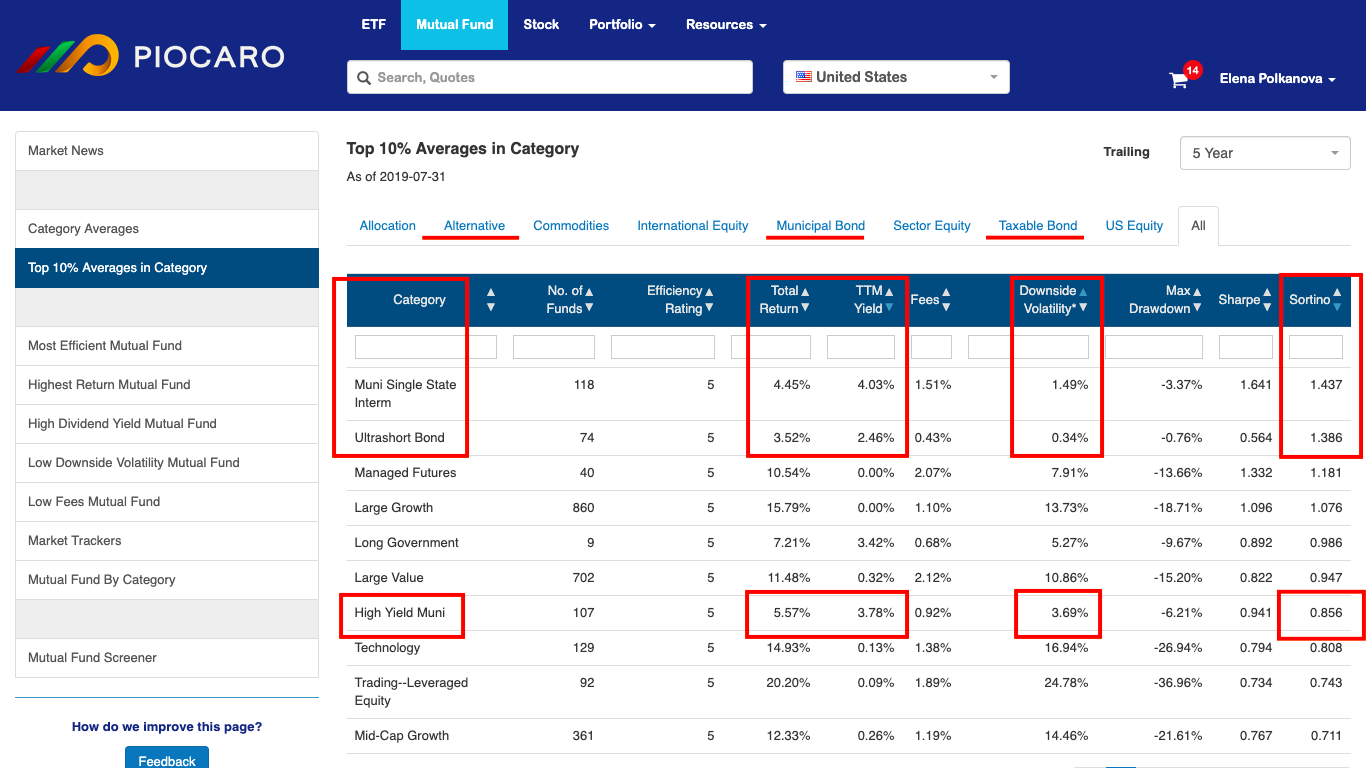

Let'a assume David wants to invest in mutual funds. Top 10% Averages in Category may be a good starting point for him to decide what assets classes and categories best meet his return and risk profile. David has low tolerance for risk and is interested in investments that pay high dividends. To identify options that fit these parameters, he can sort results by TTM Yield and Volatility or Sortino Ratio. Sortino Ratio is a good parameter to look at for investors who are cautious about risk because it accounts for downside (bad) volatility. Assets classes and assets with a negative Sortino ratio are unlikely to interest David as the negative ratio value means he would be better off if he invests in a risk-free asset.

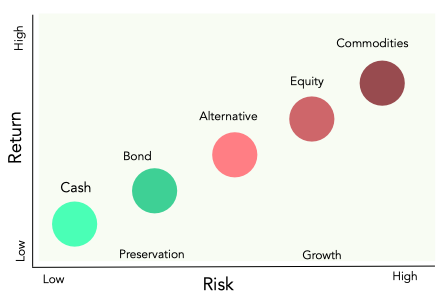

David might choose to invest across various asset classes (for example, Allocation, Alternative, Commodities, and so on) because it is an effective strategy to obtain a diversified portfolio. However, asset classes have different risk and return characteristics.

Be sure that you choose asset classes that are in line with your investment objectives.

Given David's low tolerance for risk and his objectives, he is likely to focus on fixed income assets such as Muni Single State Interim and High Yield Muni, and asset classes that bear low or medium risk, such as Taxable and Municipal Bonds and Alternative.

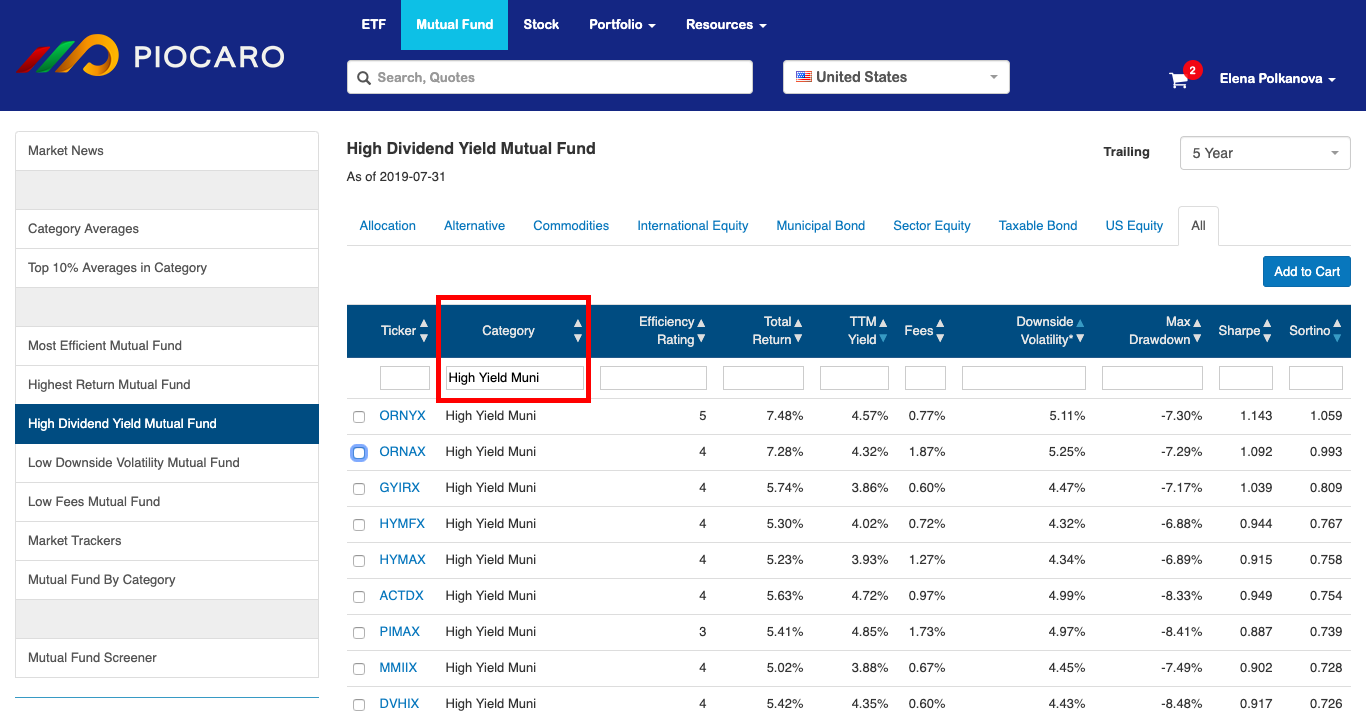

After David has some idea about asset classes and categories that meet his risk tolerance and objectives, he can use High Dividend Yield and Low Downside Volatility Mutual Funds to choose funds for his portfolio. If he wants to find funds within categories he previously selected, he can use the search box below the Category parameter and sort the results in accordance with his priorities.

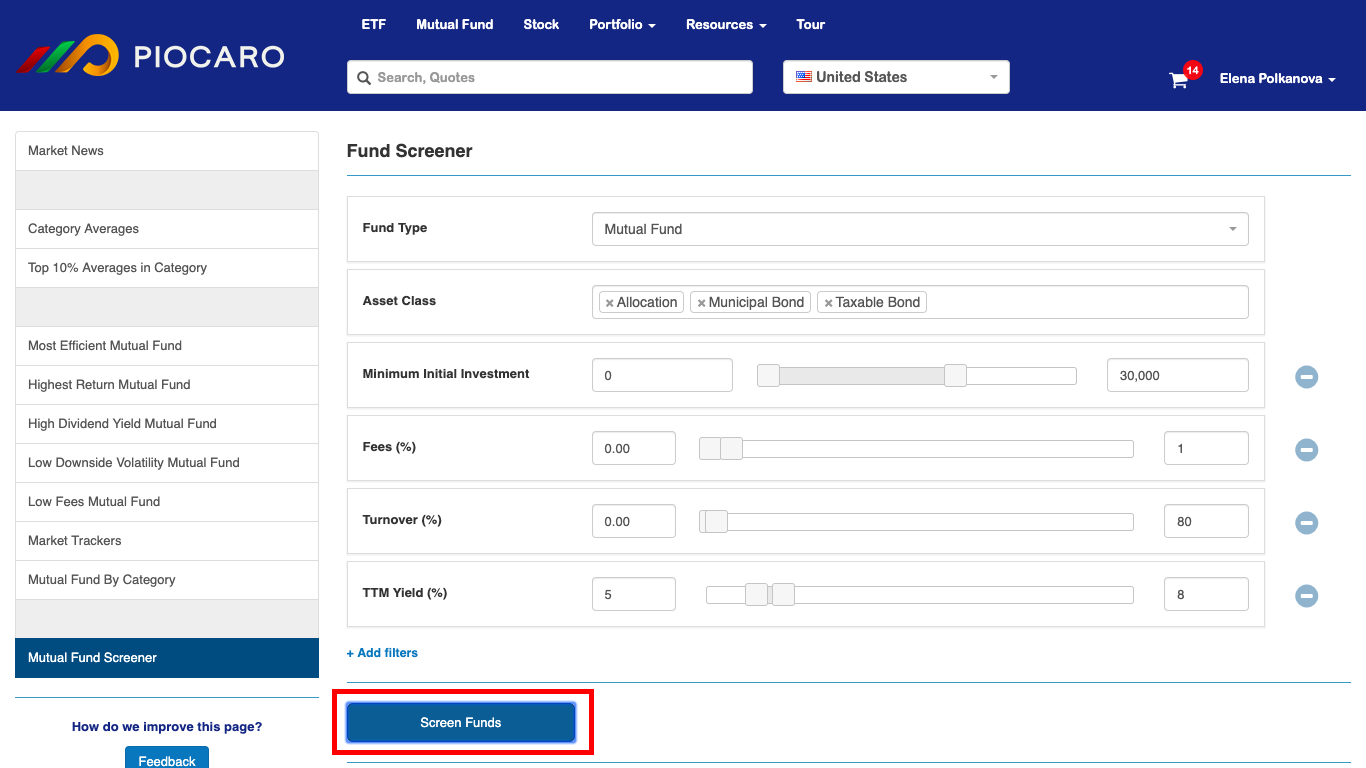

Finally, David can also use the Mutual Fund Screener to identify funds that satisfy some specific criteria.

Let's assume David wants to set Minimum Initial Investment below $30.000. He does not want to pay high management Fees and sets the fees target below 1%. He also believes that funds with high Asset Turnover require higher expense because more managerial expertise is involved and therefore he limits the turnover to 80%. He sets the Yield target between 5% and 8% as this corresponds to the return he needs to make. This is how the Screener filters look.

He can then sort and filter the search results to find the most suitable investment options.

Visit the Asset Detailed Analysis page in our User Guide to find out how to perform in-depth analysis of assets that you have discovered at this stage.